Tax treatment of micro-company

Verified 01 January 2024 - Legal and Administrative Information Directorate (Prime Minister), Ministry of Finance

As a micro-entrepreneur, you are subject to the so-called “micro-tax system”. You are also subject to the micro-social scheme as regards your social contributions and contributions. To learn more about the micro-social scheme, you can consult the relevant sheet.

You are subject to the micro-company regime if your turnover HT: titleContent do not exceed one of the following thresholds depending on the nature of your business:

- For business activities and the supply of accommodation (hotels, bed and breakfasts, rural cottages classified as furnished apartments, furnished apartments), the threshold is €188,700.

- For service activities and if you are a professional, the threshold is €77,700.

If the activity is created during the year, the thresholds must be adjusted to pro rata temporis operating, except in the case of seasonal companies.

In the case of mixed activity (sale and provision of services), the following two thresholds shall not be exceeded:

- The CAHT: titleContent global (CAHT: titleContent sale + CAHT: titleContent provision of services) must not exceed €188,700

- The CAHT: titleContent relating to the provision of services shall not exceed €77,700

If your turnover exceeds these thresholds, you cannot benefit from the micro-company scheme.

Ouvrir l’image dans une nouvelle fenêtre

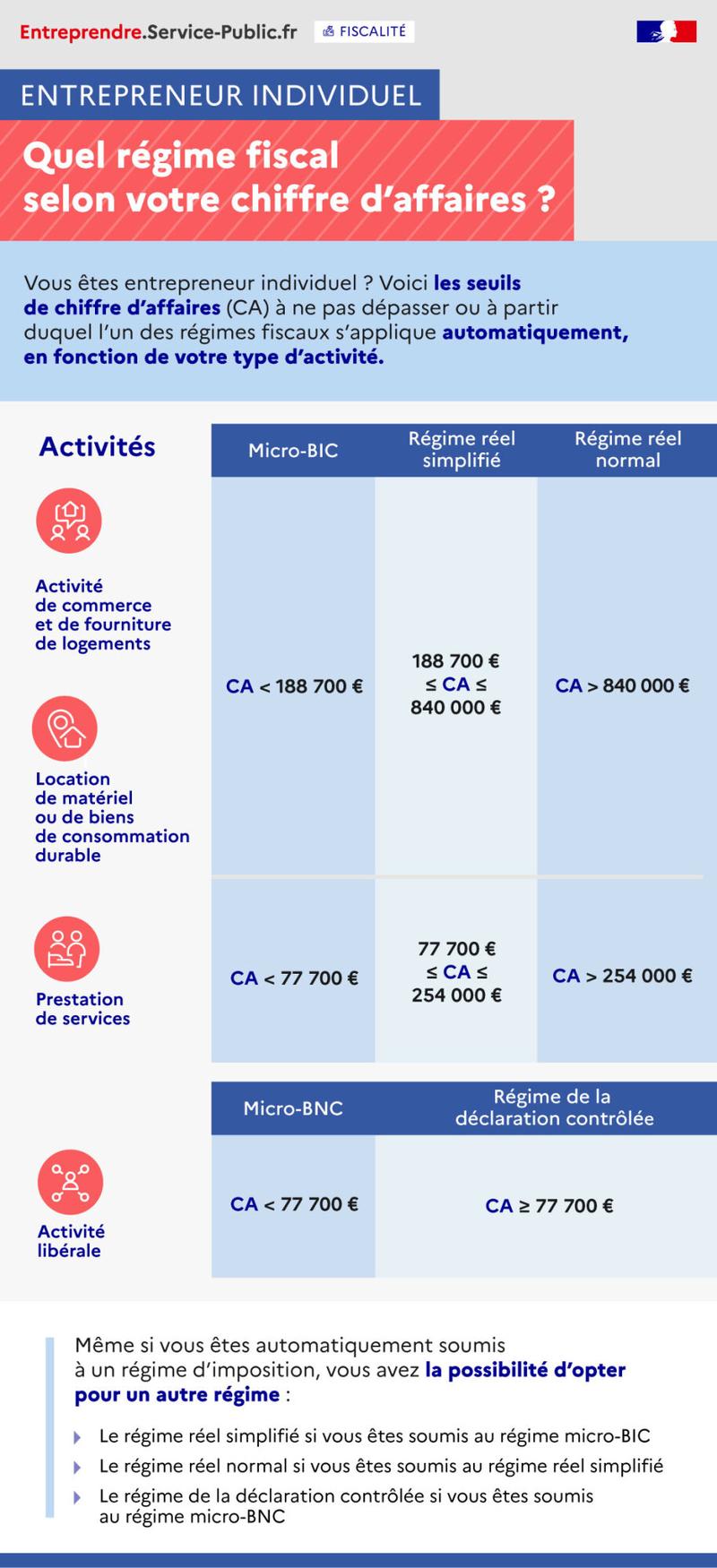

Are you an individual entrepreneur? Here are the turnover thresholds (CA) that should not be exceeded or from which one of the tax regimes applies automatically, depending on your type of activity.

Activities | Micro-BIC | Simplified real regime | Normal Actual Speed |

|---|---|---|---|

Micro-BNC | Arrangements for the controlled declaration | ||

Business of trade and supply of housing | CA < €188,700 | €188 700 ≤ CA ≤ €840 000 | CA > €840,000 |

Rental of equipment or consumer goods | |||

Provision of services | CA < €77,700 | €77 700 ≤ CA ≤ €254 000 | CA > €254,000 |

Liberal activity | CA < €77,700 | CA ≥ 77,700€ | |

Even if you are automatically subject to a tax regime, you have the option of opting for another regime:

- The real simplified scheme if you are subject to micro-BIC

- The normal actual regime if you are subject to the simplified actual regime

- The controlled declaration procedure if you are subject to the micro-BNC procedure

You are taxed on income tax either under the traditional micro-company tax system or on the final payment.

The classic micro-company tax regime is applicable when you are taxed on income in one of the following income categories:

- You are engaged in a commercial, industrial or craft activity, this will be the category of industrial and commercial profits (micro-BIC)

- If you are a professional, this will be the category of non-commercial profits (micro-NBC)

You do not have to provide a professional profit statement for your NBCs or BICs. You just have to add your profits to your supplementary income tax return (No 2042-C Pro) :

- The annual amount of your gross turnover (BIC) will have to be indicated in the section “Professional industrial and commercial income”

- The amount of your revenues (NBC) will have to be indicated in the "Non-commercial revenues" section

You must also mention any gains or losses realized or incurred during the year in question.

You must include the following information on your income tax return in the section "Identification of self-employed persons":

- Your marital status

- Address of your main establishment

- Your SIRET number

- Nature of your realized income (BIC or BNC)

Taxable profit is determined by the tax administration. It shall apply to the declared turnover one of the lump-sum allowances following depending on your type of activity:

- 71% of the CA: titleContent for activities of purchase-resale or supply of accommodation (for furnished rentals this only concerns furnished rentals of tourism and bed and breakfast)

- 50% of the CA: titleContent for other BIC activities

- 34% of the CA: titleContent for NLCs

The reduction may not be less than €305.

Once calculated, taxable profit is subject to income tax (IR)together with other income from the tax household and the tax is levied at source.

Warning

The 2024 budget amended the rules on direct or indirect rentals of furnished tourist accommodation. They will be added to our page as soon as we have more details on the subject.

If you are engaged in mixed activities, the rebates are calculated separately for each part of the turnover corresponding to the activities carried on. In this case, the minimum deduction is €610.

Example :

You are engaged in a sales activity and you have a turnover excluding tax of €175,000 in 2024.

The calculation of the allowance is as follows: €175,000 x 71% = €124,250

The taxable net profit is therefore: €175,000 - €124,250 = €50,750.

As a micro-entrepreneur, you can choose to be subject to the discharge if you meet certain conditions. It allows you to pay your taxes and social contributions at the same time.

In order to opt for the discharge payment, you must have a reference tax income for the penultimate year of the tax household that is less than one of the following amounts depending on your family situation:

- If you're a single person, €27,478

- If you are in a couple and on the same tax household, €54,956

- If you are a couple in the same tax home with 1 child, €68,695

- If you are a couple in the same tax home with 2 children, €82,434

If you exceed the threshold that corresponds to your situation, you will not be able to opt for the discharge payment.

The final payment on the tax side is equal to one of the following rates depending on your activity:

- For companies engaged in the sale of goods, articles, supplies and foodstuffs to be taken away or consumed, 1% of the CAHT: titleContent

- For companies engaged in the provision of services, 1.7% of the CAHT: titleContent

- For taxpayers who hold NBC, at 2.2% of revenue HT: titleContent

To these rates are added the social component rates (contributions) which also differ according to your activity:

- For companies engaged in the sale of goods, articles, supplies and foodstuffs to be taken away or consumed, 12.3% of the CAHT: titleContent

- For companies engaged in the provision of services, 21.2% of the CAHT: titleContent

- For taxpayers who hold NBC, at 21.2% of revenue HT: titleContent

You must deposit every month or quarter your sales statement or recipe on www.autoentrepreneur.urssaf.fr depending on the declaration option you have chosen.

Micro-entrepreneurs: online turnover reporting (simplified micro-social scheme)

Please note

If your turnover is 0, you do not have to pay taxes or social security contributions. On the other hand, you are obliged to declare your income, and register nothingness instead of the amount of your turnover.

You must declare that you wish to opt for the final payment to theUrssaf: titleContent (or the general social security funds overseas) before one of the following dates depending on your situation:

- Before 30 September of the previous year the one for which you are requesting the discharge payment. If you apply before September 30, 2022, the final payment will apply to income received on or after the firster January 2023.

- If you start your business, before the end of 3e month after the month of creation on your company. If you started your business in September 2022, you must apply for your discharge before November 30, 2022.

In case of an option for the discharge, you must address the supplementary income tax return (No 2042-C Pro) the turnover of your micro-company. You must enter your turnover in the “ Micro-entrepreneurs who have opted for the final withholding of income tax ”.

Warning

You should consider removing the deposit calculated by the tax administration on your income from the withholding tax when you opt for the final lump sum payment. To delete the deposit that will be taken for your tax household, you must log in to your special space on the website Impt.gouv.fr and access the service " Manage my direct debit ”

You can end the option for the final lump sum payment in one of the following ways:

- You can opt out. The complaint is made in the same way as the request for an option, i.e. by contacting the Urssaf or the general social security funds.

Micro-entrepreneurs: online turnover reporting (simplified micro-social scheme)

- You are getting out of the micro-company regime, that is, if you exceed revenue thresholds under the micro-tax system.

- You're exceeding the thresholds to opt for the discharge.

Répondez aux questions successives et les réponses s’afficheront automatiquement

Micro-BIC

You are automatically subject to the micro-BIC system, but you have the option to change your tax system and opt for a normal effective taxation system.

The option must be requested before one of the following dates depending on your situation:

- On your previous year's tax return that for which the option is to be exercised.

- If you were subject to the effective tax regime the previous year, at the time of your income tax return for the year for which the option is to be exercised

- If you are starting your activity with the option and want to take this option directly, you must do so when you file your first tax return

This change of tax regime does not prevent you from continuing to benefit from the micro-tax regime of VAT. You will thus be able to continue to benefit from the exemption from VAT.

This option is taken for a period of one year and tacitly renewed for a new year as long as you remain within the scope of the micro-company tax system. That is, as long as you do not exceed the turnover thresholds.

If you wish to opt out of this option, you must do so at the previous year's tax return the one for which you want to waive the option.

Micro-BNC

You are automatically subject to the micro-BNC regime, but you have the option to change the tax regime and opt for the controlled declaration regime.

The option must be requested from the company Tax Office before one of the following dates depending on your situation:

- During your income tax return for the year for which the option is to be exercised

- If you are starting your activity with the option and want to take this option directly, you must do so when you file your first tax return

Who shall I contact

This change of tax regime does not prevent you from continuing to benefit from the micro-tax regime of VAT. You will thus be able to continue to benefit from the exemption from VAT.

This option is taken for a period of one year and tacitly renewed for a new year as long as you remain within the scope of the micro-company tax system. That is, as long as you do not exceed the turnover thresholds.

If you wish to opt out of this option, you must do so at the previous year's tax return the one for which you want to waive the option.

Tax treatment of micro-companies

Discharge payment for individual operators

CVAE turnover

FAQ

Service-Public.fr

Ministry of Economy

Ministry of Economy