Do you pay customs duties on your purchases when you return from a trip (EU and foreigner)?

Verified 07 December 2023 - Legal and Administrative Information Directorate (Prime Minister)

You are returning to France from a trip and you have made personal purchases. According to your country of destination, the nature and the quantity of goods, you may or may not have to pay customs duties or VAT.

The situation varies depending on whether you made these purchases during a trip to a the European Union (EU) or located abroad, i.e. outside the EU.

Warning

The country are not affected by the buying rules in EU: titleContent, but by those for purchase on theforeigner (i.e. outside the EU) or by special rules: Guyana, Meeting, Mayotte, Guadeloupe and Martinique, French Polynesia, St Pierre and Miquelon, Wallis and Futuna, Saint Barthelemy and Saint Martin, New Caledonia, Channel Islands, Canary Islands, Andorra, Switzerland.

EU countries

When you return to France from a country in theEuropean Union (EU), you have no customs charges on your purchases.

You don't file a return.

You do not pay any duties or taxes upon your return to France.

You pay VAT directly in the country where you make your purchases and at the rate in force there.

Warning

Be vigilant at restrictions of quantities on certain goods (see below) such as tobacco or thealcohol, the food and plants ; if you exceed the quantities, you will have fees payable and your goods will be confiscated.

Restrictions specific to certain goods

The carriage of the following goods is authorized according to specific conditions :

- Cash

- Tobacco and alcohol

- Pet

- Weapons and ammunition

- Sensitive goods : medicine, work of art, food product (fruit, vegetables, meat), plants

Prohibitions

He is forbidden to transport drugs, counterfeit goods and protected animal or plant species.

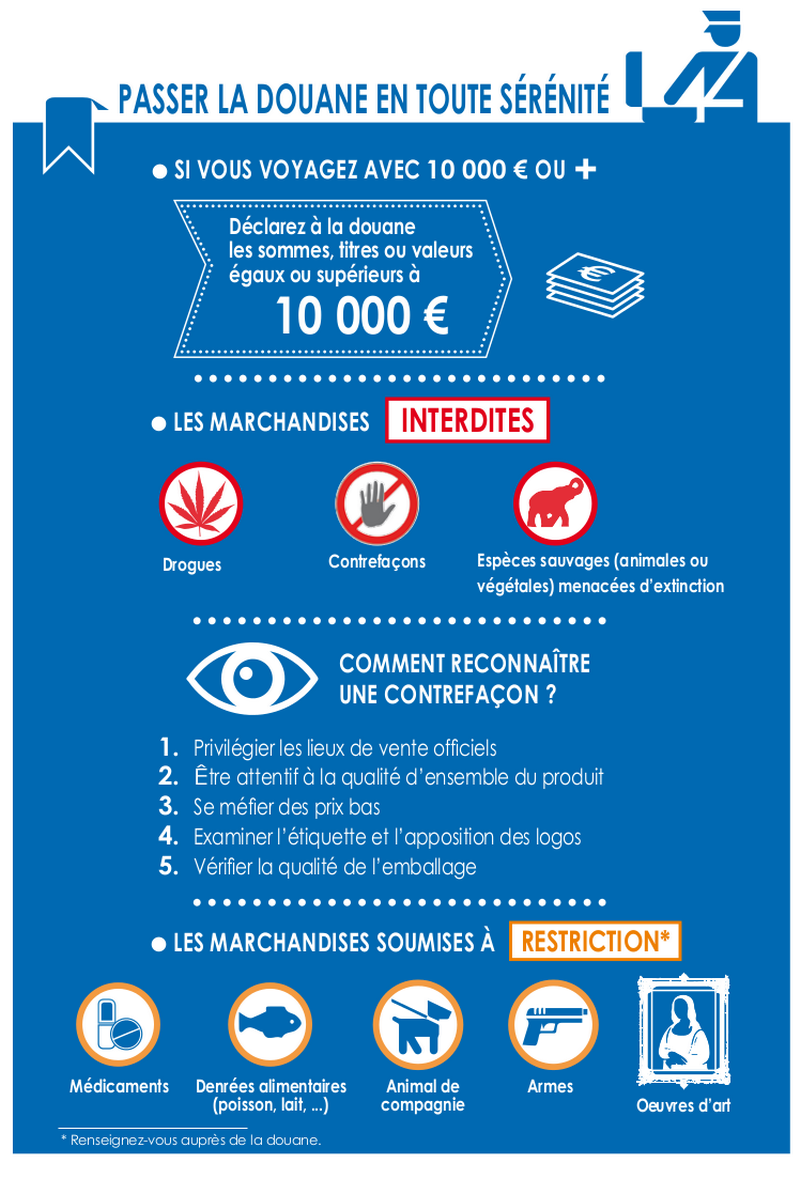

Ouvrir l’image dans une nouvelle fenêtre

If you are traveling with €10,000 Euros or more in cash, you must declare to customs the sums, securities or securities.

Drugs, counterfeits and endangered species of wild animals and plants are prohibited. To know when to recognize a counterfeit, you can follow these tips:

- Prefer official sales locations

- Be attentive to the overall quality of the product

- Beware of low prices

- Review the label and logo affixing

- Check the quality of packaging

Some goods are subject to special restrictions, such as medicines, food, pets, weapons and works of art.

non-EU foreigner

You only pay customs duties if your purchases overtake a certain value.

Find below the amount authorized for your purchases, according to the mode of transport and depending on the type of goods.

Amounts are valid for 1 person and for the all your purchases.

You benefit from some deductibles for purchases you make abroad.

A deductible is thresholds of value (in euros) and thresholds of quantities.

If you purchase items or bring back quantities above these thresholds, then you must to declare the goods customs and pay customs duties.

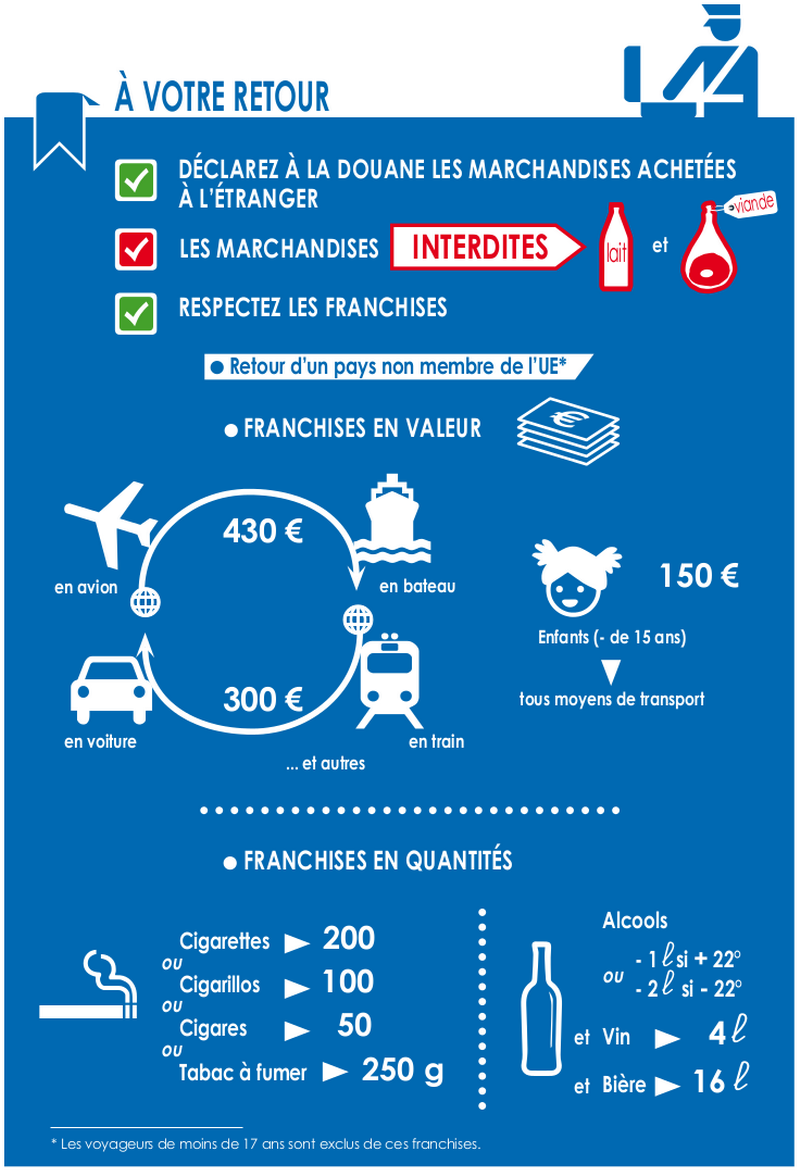

Image summary on franchises: how to pass customs in peace?

Ouvrir l’image dans une nouvelle fenêtre

Upon your return from the foreigner (i.e. a country outside the European Union), you have to declare the goods purchased to customs and you have to respect the duty-free allowances in value and quantity.

The prohibited goods are meat and milk.

Values are limited to €430 euros per person when traveling by plane or boat. By train or car these same values are limited to €300 euros per person. For a person under 15 years of age, the franchise limit value is €150 euros regardless of the mode of transport.

The quantities of tobacco and alcohol are regulated. For tobacco you are limited to 200 cigarettes (i.e. one carton), or 100 cigarillos or 50 cigars or 250 grams of smoking tobacco per person. For alcohol, you are limited to 1 liter of alcohol greater than 22 degrees or 2 liters of alcohol less than or equal to 22 degrees; you can add to these quantities a maximum of 4 liters of wine and a maximum of 16 liters of beer per person.

These alcohol and tobacco rules apply to people over the age of 17. For persons aged 17 and below, all such goods in any quantity are prohibited.

Example :

You return to France, by train or car, and you bring back equipment (a camera for example) by a value of plus of €300, then you must declare and pay a customs duty.

In value

All object purchased abroad, including value overshoot the duty-free allowance must be declared to Customs and you will have to pay customs duties.

If you are bringing back multiple items, the value allowance applies to the total goods purchased.

Category of traveler | Total value of goods admitted free of customs duty (per person) |

|---|---|

Traveler over 15 years of age - Air or marine | €430 |

Traveler over 15 - Other mode of transport (car, train, bicycle, etc.) | €300 |

Traveler under 15 years of age - Regardless of mode of transportation | €150 |

Example :

A group or family of 4 people may not benefit from the exemption of €430 for a purchased item with a value of €1,720 (€430 (x 4). An object and its total value are attached to 1 person. It has to be declared and you pay the customs duty.

Customs has a simulator available to help you calculate any customs duties you may have to pay.

Calculate customs duties on your purchases abroad, outside the EU

In quantity

Only products of the tobacco and alcohol are concerned by the quantity allowances.

You do not have to file a declaration or pay any tax at customs, if your quantities of tobacco and of alcohol do not exceed fixed thresholds.

Please note

More restrictive thresholds apply for residents and frontier workers to theEU: titleContent and for travelers from Andorra.

For more information, you can contact by phone Customs Info Service:

Who shall I contact

Customs Service Info

To obtain customs information concerning export, import, customs forms, transport and border crossing, exemptions...

By telephone

0 800 94 40 40

Open from Monday to Friday from 8:30am to 6pm

Toll-free number, local call price

Outside metropolis or from the foreigner, dial +33 1 72 40 78 50

By E-mail

Access to contact form

Prepare your trip with “DeclareCustoms”

Customs provides an online information serviceaid preparing for customs procedures based on purchases made abroad.

This online service called DeclareCustoms indicates the documents to be provided for customs clearance and the estimation of duties to be paid.

FYI

If you bring back multiple objects, the value allowances shall apply to the total purchases. Goods whose value exceeds the duty-free allowance are taxed.

For more information, you can contact by phone Customs Info Service:

Who shall I contact

Customs Service Info

To obtain customs information concerning export, import, customs forms, transport and border crossing, exemptions...

By telephone

0 800 94 40 40

Open from Monday to Friday from 8:30am to 6pm

Toll-free number, local call price

Outside metropolis or from the foreigner, dial +33 1 72 40 78 50

By E-mail

Access to contact form

You can also contact directly one of the customs offices in France or abroad:

Who shall I contact

Make the declaration

You must declare verbally to customs agents the goods that you have purchased and that you wish to bring into France.

To do this, you must introduce you to to customs office from the place of your entry into France or at the goods declaration office at the airport.

The statement must be made before entry in France.

Depending on your goods, Customs officers decide whether the declaration is to be made in writing or only orally.

The customs authorities also decide on any customs duties you may or may not have to pay.

These taxes apply to the price mentioned on the invoice of purchase.

If you do not present the invoice for your purchase, taxes apply on the estimated value of the goods.

One misrepresentation or theabsence of declaration has the following consequences:

- Payment customs duties and payment of taxes

- Confiscation of your goods

- Possible criminal sanctions (fines and/or imprisonment)

Customs officers will issue you a receipt and/or a minutes (minutes).

Who can help me?

Find who can answer your questions in your region

For all your questions by phone or email

Customs Service Info

To obtain customs information concerning export, import, customs forms, transport and border crossing, exemptions...

By telephone

0 800 94 40 40

Open from Monday to Friday from 8:30am to 6pm

Toll-free number, local call price

Outside metropolis or from the foreigner, dial +33 1 72 40 78 50

By E-mail

Access to contact form

- Customs offices (French and foreigners)

Total market value of goods admitted free of customs duty by type of passenger and transport

Customs tickets, 1st class

Customs 2nd Class Tickets

Customs 3rd Class Tickets

4th Class Customs Tickets

5th Class Customs Tickets

Customs offenses 1st class

2nd class customs offenses

3rd class customs offenses

Ministry of Finance

Ministry of Finance

Swiss Confederation

Directorate General of Customs and Indirect Taxes

Directorate General of Customs and Indirect Taxes

Directorate General of Customs and Indirect Taxes

Ministry for Europe and Foreign Affairs