Le lien vers cette page a été envoyé avec succès aux destinataires.

Income Tax - Children's Tuition Fees (Tax Cut)

Verified 17 April 2024 - Directorate for Legal and Administrative Information (Prime Minister)

A group of people who complete a single tax return (e.g., spouse, dependent children)

What applies to you ?

Ouvrir l’image dans une nouvelle fenêtre

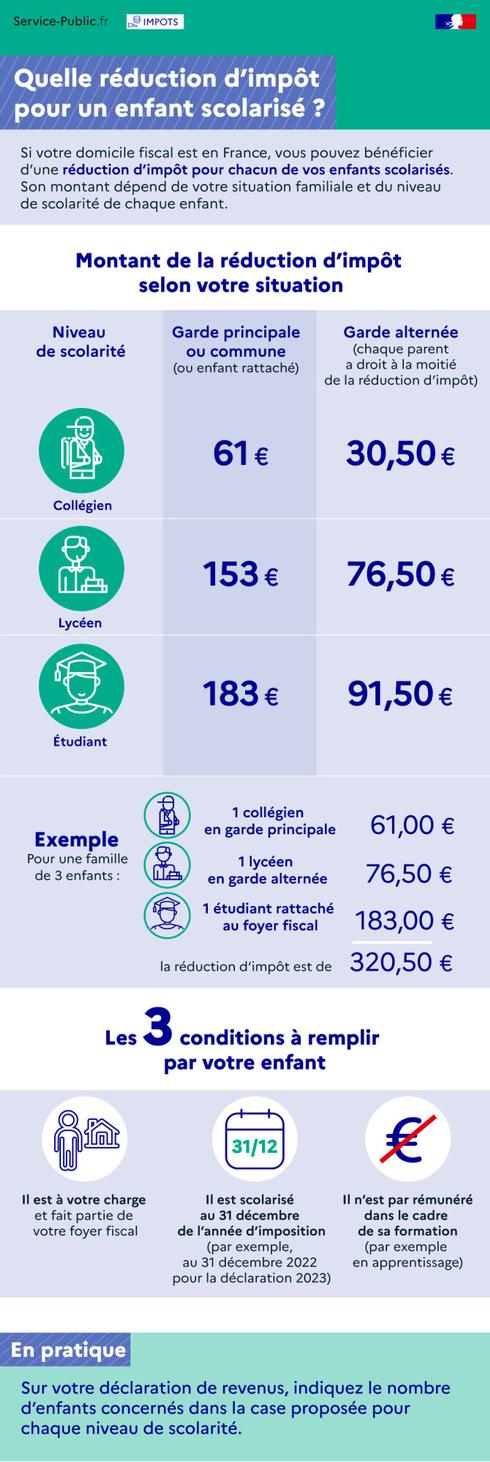

Title: What tax cut for a child in school?

If your tax residence is in France, you can benefit from a tax reduction for each of your school children. The amount depends on your family situation and the level of education of your children.

Amount of the tax reduction depending on your situation

1/ Common or main custody (or child attached:

- College student: 61 €

- High school student: 153 €

- Student: 183 €

2/ Alternate custody

- Middle-school student: 30,50 €

- High school student: €76.50

- Student: 91,50 €

Example:

For a family of 3 children including 1 secondary school student in alternate care, 1 middle school student in primary care and 1 student attached to the tax shelter, the tax reduction is €320.50 (61 + 76.50 + 183).

The 3 conditions to be fulfilled by your child in school:

- It's your dependant and part of your tax household

- He is in school as of December 31 of the tax year (for example, as of December 31, 2022 for the 2023 return)

- He is not paid for his training (e.g. apprenticeship).

In practice: On your tax return, indicate the number of children involved at each level of education.

Child in primary or exclusive custody

You can benefit from a tax reduction when your dependent child pursues secondary education (middle or high school) or higher.

Affected children

If it's your charge, your child allows you to get a tax reduction.

If it is of age, it must be attached to your tax shelter.

In order to benefit from the tax reduction, your child must complete as part of his training the 2 conditions following:

- He is not bound by a contract of employment. He is free of all commitments during and after his studies

- He is not paid

Your child won't tell you does not benefit the reduction if it is in any of the following situations:

- Learning

- Training Leave

- Study contract with employer

Please note

Your child can be a scholarship holder and receive compensation during a mandatory internship.

Education and relevant studies

Your child should continue to secondary or higher education during the current school year, on December 31 of the taxation year.

The amount of the reduction depends on the class in which he was at that time.

Example :

In 2024, for the 2023 tax return, the child must have been in school by December 31, 2023.

The amount of the reduction corresponds to the class in which it was at 31 December 2023.

The studies can be taken in a public or private institution, located in France or abroad.

Correspondence courses are eligible for the reduction only if they are initial training through the Center national d'éducation à distance (Cned).

Tax domicile

Your tax domicile must be in France.

The amount of the reduction depends on the level of education.

Level | Reduction (per child) |

|---|---|

College | €61 |

High School | €153 |

Higher education | €183 |

You must indicate on your return the number of dependent children attending school in middle school, high school or higher education.

You do not have to attach the child's school certificate, but keep it if requested by the tax authorities.

You must specify the number of children in the part Tax reductions - Tax credits under Number of dependent children continuing their education :

2024 Online Income Tax Return 2023

You will need to add the form to your return Tax reductions - Tax credits and complete the Number of dependent children continuing their education :

2024 Income Tax Return 2023 - Tax Reductions and Tax Credits

Please note

The relevant boxes are indicated in the practical tax booklet on tax returns.

Child in alternate residence

You can benefit from an income tax reduction when your dependent child pursues secondary education (middle or high school) or higher.

Affected children

If it's your charge, your child allows you to get a tax reduction.

If it is of age, it must be attached to your tax shelter.

In order to benefit from the tax reduction, your child must complete as part of his training the 2 conditions following:

- He is not bound by a contract of employment. He is free of all commitments during and after his studies

- He is not paid

Your child won't tell you does not benefit the reduction if it is in any of the following situations:

- Learning

- Training Leave

- Study contract with employer

Please note

Your child can be a scholarship holder and receive compensation during a mandatory internship.

Education and relevant studies

Your child should continue to secondary or higher education during the current school year, on December 31 of the taxation year.

The amount of the reduction depends on the class in which he was at that time.

Example :

In 2024, for the 2023 tax return, the child must have been in school by December 31, 2023.

The amount of the reduction corresponds to the class in which it was at 31 December 2023.

The studies can be taken in a public or private institution, located in France or abroad.

Correspondence courses are eligible for the reduction only if they are initial training through the Center national d'éducation à distance (Cned).

Tax domicile

Your tax domicile must be in France.

The amount of the reduction depends on the level of education.

Level | Reduction (per child) |

|---|---|

College | €30.50 |

High School | €76.50 |

Higher education | €91.50 |

You must indicate on your return the number of dependent children attending school in middle school, high school or higher education.

You do not have to attach the child's school certificate, but keep it if requested by the tax authorities.

You must specify the number of children in the part Tax reductions - Tax credits under Number of dependent children continuing their education :

2024 Online Income Tax Return 2023

You will need to add the form to your return Tax reductions - Tax credits and complete the Number of dependent children continuing their education :

2024 Income Tax Return 2023 - Tax Reductions and Tax Credits

Please note

The relevant boxes are indicated in the practical tax booklet on tax returns.

Who can help me?

Find who can answer your questions in your region

For general information

Tax Information Service

By telephone:

0809 401 401

Monday to Friday from 8:30 am to 7 pm, excluding public holidays.

Free service + call price

To contact the local service managing your folder

Department in charge of taxes (treasury, tax department...)

Tax reduction for tuition fees for children pursuing secondary or higher education

FAQ

Ministry of Finance

Ministry of Finance