Make a donation

Verified 17 December 2024 - Directorate for Legal and Administrative Information (Prime Minister)

You want to transfer ownership of one of your properties to another person for free before your death? For this, you can make a donation. There are certain rules you must follow to make a donation valid. The donation must be made in particular by notarial act. Here's the information you need to know.

A donation is an act by which you, the donor, transfer ownership of a property to a donee.

The donee must expressly accept the donation to make it happen.

Warning

Donation is different from manual donation and the customary gift.

To make a donation, you must complete the 3 conditions following:

- To be sane, that is to say to have mental capacities allowing a discernment and a sufficiently enlightened will

- Be of age or emancipated minor

- Own the legal capacity to manage your property.

The person in guardianship may, with the authorization of the judge or the family council if it has been set up, be assisted or if necessary represented by the guardian to make donations.

The person curatorship may make a donation with the assistance of the curator.

You can make a donation to the person of your choice:

- Your children or grandchildren

- No one you live with as a couple

- Other member of your family

- No one outside your family.

You can also make a donation to certain associations.

If you are married, you can make a donation to your spouse. This is a gift to the last living.

The donation must be accepted by the donee. He can also refuse it.

A minor can receive a donation. In this case, the donation must be accepted by his legal representatives.

If the donee is deaf-mute and knows how to write, he can accept the donation himself or go through a authorisation holder. If he does not know how to write, the donation must be accepted by a curator appointed for that.

The property must be yours personally at the time of donation. It is impossible to give a future good except in a gift to the last living.

Example :

You cannot give away property that you will inherit when your parents die.

You can give real estate or furniture.

You must follow the transmission rules imposed by law.

The heirs reserving cannot be excluded from your estate. They must receive a minimum share of inheritance. So you can freely give the part that exceeds the hereditary reserve. This part is called the available quota.

If you do not comply with this rule, your heirs can call into question your donations at the time of the settlement of your estate. To do that, they have to make a reduction action.

FYI

the heir making the reservation may waive in advance the right to contest a donation which would deprive him of his share of the inheritance. It must express this will in a succession pact.

However, if you have no heirs as a reserving member, you can give away all your assets.

Presence of child

Number of children | Available Quota |

|---|---|

1 | 1/2 |

2 | 1/3 |

3 or more | 1/4 |

Example :

You have a heritage of €200,000 and three children. At the time of your succession, your children will share 3/4 of this heritage either €150,000 in equal parts. Each child will therefore receive €50,000. So you can give the remaining 1/4 either €50,000 to persons of your choice (heirs or third parties).

if you made a donation to your child and he dies without progeny, you can recover the donated goods. This is called the right of legal return. You can also plan a return clause in the deed of gift: you recover the donated goods if the donee dies before you, with or without descendants.

Absence of child

Marital status | Available Quota |

|---|---|

Married | 3/4 |

Unmarried | All |

Example :

You have a heritage of €200,000. At the time of your estate, your husband will receive €50,000. You can give the €150,000 remaining to the persons of your choice (heirs or third parties).

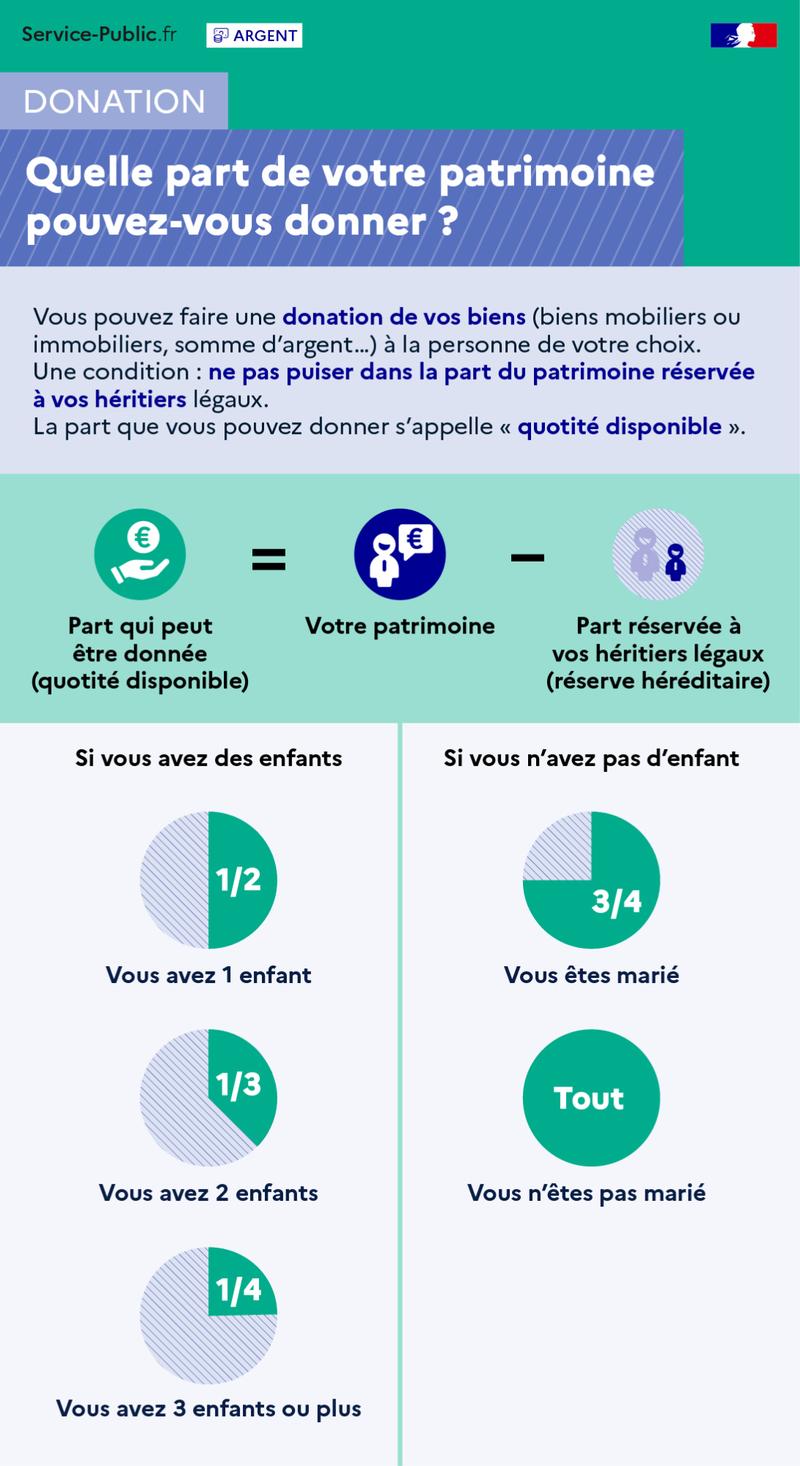

Ouvrir l’image dans une nouvelle fenêtre

Donation

How much of your wealth can you give?

You can make a donation of your property (movable or immovable property, amount of money...) to the person of your choice.

One condition: do not draw on the part of the heritage reserved to your legal heirs.

The share you can give is called "available quota".

Share that can be given (available share) = your assets - share reserved for your legal heirs.

Number of children | Available Quota |

|---|---|

1 | 1/2 |

2 | 1/3 |

3 or more | 1/4 |

Marital status | Available Quota |

|---|---|

Married | 3/4 |

Unmarried | All |

The donation is made by notarial deed.

Who shall I contact

Taxation

You have to pay gift tax. However, in some cases, you can to be exempted.

If your donation includes a real estate, you also have to pay land advertising costs.

Notary's fees

In case of donation by notarial deed, you will have to pay notary's fee.

The amount of emoluments that you must pay to the notary are proportional to the value in full ownership donated goods.

Donation Type | Value of the property Trim Slices | Cost |

|---|---|---|

Donation of intangible property, money | From €0 to €6,500 | 2,322% HT, or 2,786% VAT of the value of the property |

From €6,500 to €17,000 | 0.958% excl. VAT, or 1.149% incl. of the value of the property | |

From €17,000 to €60,000 | 0.639% HT, or 0.767% VAT of the value of the property | |

More than €60,000 | 0.479% HT, or 0.575% VAT of the value of the property | |

Other donations | From €0 to €6,500 | 4,837% HT, or 5,804% VAT of the value of the property |

From €6,500 to €17,000 | 1.995% HT, or 2.394% VAT of the value of the property | |

From €17,000 to €60,000 | 1,330% HT, or 1,596% VAT of the value of the property | |

More than €60,000 | 0.998% excl. VAT, or 1.1976% incl. of the value of the property |

The effect of the gift is to immediately transfer ownership of the donated property to donee.

The donation is enforceable to third parties.

In principle, a donation cannot be revoked, i.e. canceled. However, there are exceptions.

Defect in form

If the donation has not been expressly accepted or if it has not been made before a notary, it may be canceled.

Cancelation may be requested by any person interested in the donation: the donor, the donee, an heir or a creditor.

You can seek annulment in court within a period of 5 years from the day the donation was made.

Who shall I contact

After the development of a fact

You can request the cancelation of your donation in 3 cases.

Répondez aux questions successives et les réponses s’afficheront automatiquement

Non-performance of the obligations laid down in the donation

A donation may require the donee to perform certain duties.

Example :

the donee may be required to provide accommodation, food, and health care to donor.

If the donee does not fulfill his obligations, you can request the cancelation of your donation by subpoena in court.

Who shall I contact

You must request cancelation within 5 years from the day on which the donee ceases to perform his duties.

The judges determine whether the alleged acts are sufficiently serious to allow the donation to be canceled.

Ingratitude

You can request cancelation for ingratitude if the donee is in any of the following cases:

- He tried to kill you

- He committed crimes offenses, insult or severe abuse against you

- He refused to provide you with food aid, that is, financial or in kind to allow you to survive.

The facts must have been clerk after the donation.

You must request cancelation by subpoena in court.

Who shall I contact

You must request cancelation within1 a year from the day on which you become aware of the facts.

The judges determine whether the alleged acts are sufficiently serious to allow the donation to be canceled.

Birth or full adoption of a child

Except for gift between spouses, you can request the cancelation of a donation made when you did not have a child. To do this, you must have provided for it in the deed of donation.

You must request cancelation by subpoena in court within a period of 5 years from birth or adoption by the plenary.

Who shall I contact

Vous avez choisi

Choisissez votre cas

Non-performance of the obligations laid down in the donation

A donation may require the donee to perform certain duties.

Example :

the donee may be required to provide accommodation, food, and health care to donor.

If the donee does not fulfill his obligations, you can request the cancelation of your donation by subpoena in court.

Who shall I contact

You must request cancelation within 5 years from the day on which the donee ceases to perform his duties.

The judges determine whether the alleged acts are sufficiently serious to allow the donation to be canceled.

Ingratitude

You can request cancelation for ingratitude if the donee is in any of the following cases:

- He tried to kill you

- He committed crimes offenses, insult or severe abuse against you

- He refused to provide you with food aid, that is, financial or in kind to allow you to survive.

The facts must have been clerk after the donation.

You must request cancelation by subpoena in court.

Who shall I contact

You must request cancelation within1 a year from the day on which you become aware of the facts.

The judges determine whether the alleged acts are sufficiently serious to allow the donation to be canceled.

Birth or full adoption of a child

Except for gift between spouses, you can request the cancelation of a donation made when you did not have a child. To do this, you must have provided for it in the deed of donation.

You must request cancelation by subpoena in court within a period of 5 years from birth or adoption by the plenary.

Who shall I contact

Donation to the last living

You can cancel a gift to the last living, unless it was made under a marriage contract.

Cancelation may be effected before the notary or by will.

The donation to the last living is automatically canceled in the event of divorce, including where it was made under a marriage contract.

FYI

you can cancel a donation to the last living person without your spouse being informed.

Who can help me?

Find who can answer your questions in your region

General provisions

Conditions for making a donation

Notarized donation (Article 931), condition of acceptance (Articles 932 to 939), subject of donation (Article 943), right of return (Articles 951 and 952)

Exceptions to the rule on the irrevocability of donations

Notaries' fees relating to a donation (Article A444-67)

FAQ

Notaries of France

General Directorate of Public Finance