This page has been automatically translated. Please refer to the page in French if needed.

Taxes

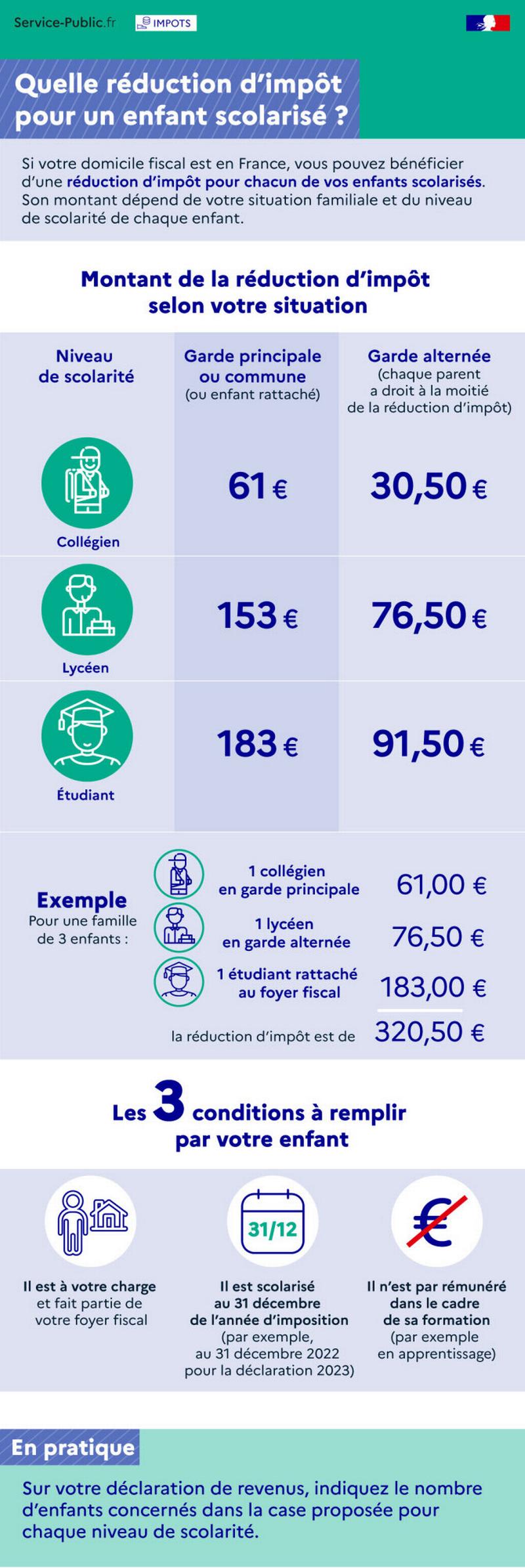

What is the tax deduction for children's education?

Publié le null - Legal and Administrative Information Directorate (Prime Minister)

You can get a tax reduction when your dependent child is in high school (college or high school) or higher. What are the exemption conditions, what discount are you entitled to and how do you have to report? Answers with Service-Public.fr.

The card Income Tax - Children's Tuition Fees (Tax Cut) Answers all your questions about the tax deductions available based on your children's education. Also find this information with a detailed infographic.

Infographie - What tax cut for a child in school?

Ouvrir l’image dans une nouvelle fenêtre

Additional topics

Service-Public.fr

Service-Public.fr

Service-Public.fr

Service-Public.fr

Legifrance

Agenda

Aide au logement

À partir du 8 juil. 2024

Publié le 24 juin 2024

Plateforme Mon Master

Du 4 juin au 31 juil. 2024

Publié le 06 juin 2024

Lycéens

À partir du 1 sept. 2024

Publié le 23 mai 2024

Collégiens

À partir du 1 sept. 2024

Publié le 22 mai 2024