Le lien vers cette page a été envoyé avec succès aux destinataires.

File a debt distress report

Verified 01 July 2022 - Directorate for Legal and Administrative Information (Prime Minister)

Person to whom money or the provision of a benefit is owed

A natural (individual) or legal person (body) who undertakes in writing (guarantee) to be paid to the landlord, including rent, charges and rental repairs where the tenant fails to do so

Corresponds to all days of the week except the weekly day of rest (usually Sunday) and public holidays usually not worked in the company

If you are unable to meet your debts or if you know that you will not be able to meet your debts, you can enter the over-indebtedness commission.

To do this, you need to make a over-indebtedness record at the Banque de France.

What applies to you ?

Veuillez patienter pendant le chargement de la page

General case

Being an individual

You must meet these 2 conditions:

- Be a Frenchman domiciled in France or abroad, or be a foreigner domiciled in France

- Be of age or emancipated minor

FYI

Individual business If you are self-employedHowever, you cannot directly file for over-indebtedness, even if your debts only concern your personal wealth. You must first go to the court of law (if you are a farmer or a professional) or the commercial court (if you are a trader or craftsman).

If you own your principal residence (home):

Your application cannot be rejected on the grounds that you own your principal residence, even if its value would allow you to pay off all or part of your debts.

When you live in a couple (marriage, Civil partnerships, cohabitation), you have 3 possibilities :

- You can file a file with 2, in common (this solution is to be preferred if you have debts in common).

- You can each file your own file (if there are debts common to the couple, you will have to indicate and justify how the burdens are shared within your couple).

- You can file a file on your own, on your behalf (if there are debts common to the couple, you will have to indicate and justify how the burdens are shared within your couple).

If you are married and you are the only one to file a file:

- At the time of filing, you are the only one registered with the National Personal Credit Reimbursement Incident File (PPIF).

- When the case is declared admissible, only seizures against you are suspended. The creditor of your spouse may request the seizure of his or her property or of property that you have in common. But if you and your husband have common debts, the suspension you are given prevents the seizure of the common property.

- When the measures to deal with over-indebtedness are applied, you are the only beneficiary. As a result, creditors can claim from your spouse the payment of the debts you have in common with him.

FYI

if you live in Alsace-Moselle, you can file a debt distress report with the Banque de France and engage a civil bankruptcy procedure specific to the inhabitants of Alsace-Moselle, because the two devices coexist.

Being in debt

These may be expenses that you have not paid or cannot pay.

As a result, you can file an over-indebtedness file:

- if you can't pay off your debts

- or if you know that soon you will not be able to pay your expenses (example: invoice). For example, you know you're going to be unemployed and you don't have a job offer.

But only everyday expenses (debts that meet personal and/or family needs) are eligible for the debt overhang file:

- Bank debt: mortgage maturities, consumer loan maturities, overdrafts

- Current expenditure: rent arrears, unpaid bills (water, gas, electricity, telephone), tax arrears, ...

- Debts that exist because you have taken out the security of an individual (example: rental deposit) or a company (individual contractor or business)

Other debts are not taken into account in the over-indebtedness procedure or are treated differently:

- Professional debts, i.e. debts directly or indirectly connected with the professional activity pursued

- Maintenance debts (maintenance payments)

- Damages awarded to victims in connection with a criminal conviction

- Penal fines

To be of "good faith"

You have to be of good faith, that is to say not having made it impossible to pay your debts and to make a sincere declaration of over-indebtedness.

To complete your case, you can be assisted by a social worker present at the CCAS: titleContent, the mayor's office, in a budget advice point, at the Caf: titleContent, in your HLM office ... In this case, enter the name and contact information of this person in your file.

It is also possible to request information or make an appointment with the Banque de France via the internet:

Request for information or appointment at the Banque de France

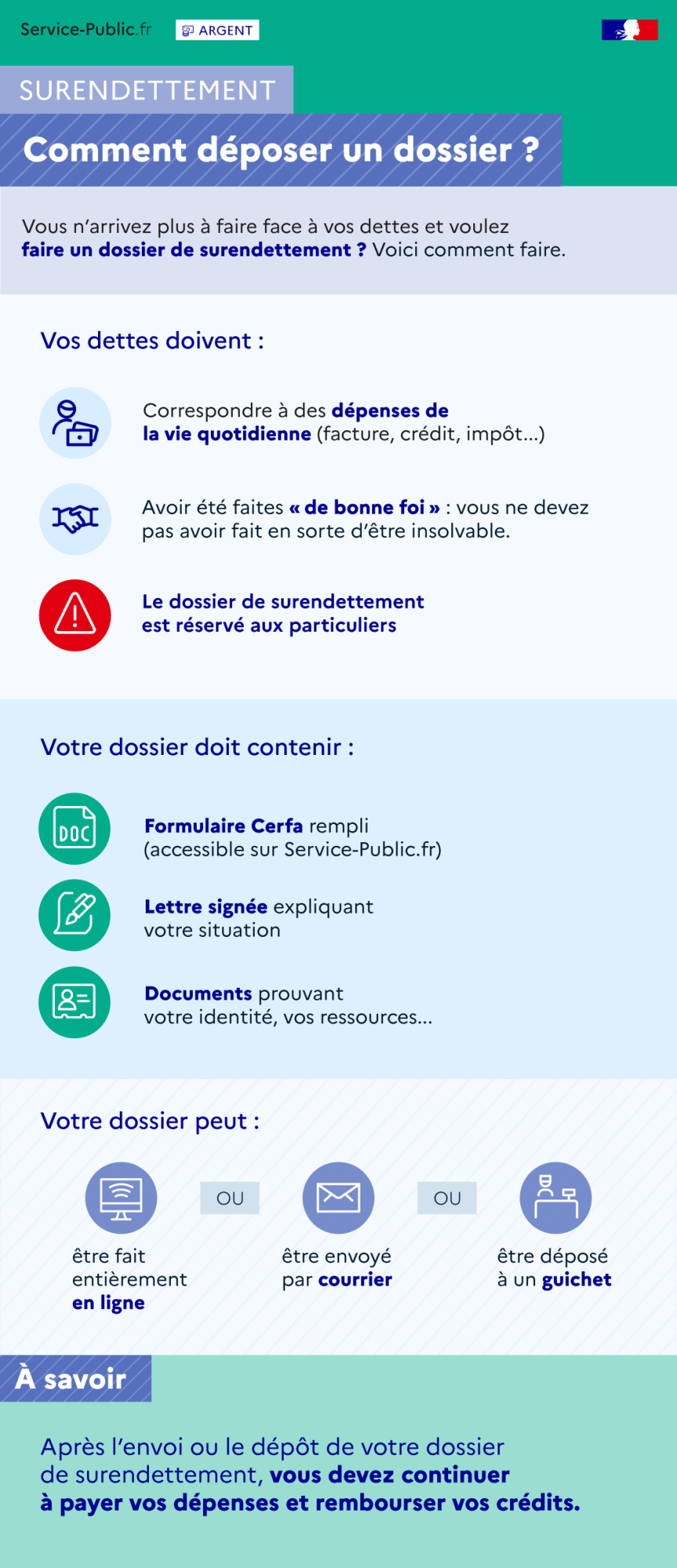

Infographie - How do I file a debt distress report?

Ouvrir l’image dans une nouvelle fenêtre

You can no longer cope with your debts and you want to make a case of over-indebtedness?

Here's how:

Your debts must:

- correspond to everyday expenses (e.g. invoice, credit, tax)

- and have been made in good faith. You must not have made yourself insolvent

Attention, the file on over-indebtedness is reserved for individuals

Your folder should contain:

- The form will be filled out. It is accessible from Service-public.fr

- A signed letter explaining your situation

- Documents proving your identity, your resources

Your folder can:

- be made entirely online

- or be sent by mail

- or be dropped off at a counter.

Be careful, after you send or submit your over-indebtedness file, you must continue to pay your expenses and repay your credits.

Répondez aux questions successives et les réponses s’afficheront automatiquement

You're doing the case for yourself

Online

The following online service shall be used:

With the form to print

Your folder should contain the following documents:

- Form cerfa n°13594 to be printed and filled in

Declaration of over-indebtedness

- Proof of identity, resources, expenditure, debts and assets

There is a list of supporting documents to be provided.

- Letter to quickly explain your current situation and the causes of your debt overhang. In particular, indicate the seizures in progress of your property or income and, if necessary, the ongoing eviction procedure. You have to sign the letter.

Letter to be attached to the debt distress file

Then you must:

- Either email your folder

- Either hand over your file to one of the Bank of France's ticket offices

Who shall I contact

Over-indebtedness: Bank of France postal address

Banque de France Over-indebtedness

TSA 41217

75035 PARIS CEDEX 01

Attention:

If your letter concerns a dossier of over-indebtedness already known to the Banque de France, you must recall its reference to 12 digits (the number assigned to the dossier by the Banque de France)

Who shall I contact

You make the file for your couple (married, past, cohabiting)

Your folder should contain the following documents:

- Form cerfa n°13594 to be printed and filled in

Declaration of over-indebtedness

- Proof of identity, resources, expenditure, debts and assets

There is a list of supporting documents to be provided.

- Letter to quickly explain your current situation and the causes of your debt overhang. In particular, indicate the seizures in progress of your property or income and, if necessary, the ongoing eviction procedure. You have to sign the letter.

Letter to be attached to the debt distress file

Then you must:

- Either email your folder

- Either hand over your file to one of the Bank of France's ticket offices

Who shall I contact

Over-indebtedness: Bank of France postal address

Banque de France Over-indebtedness

TSA 41217

75035 PARIS CEDEX 01

Attention:

If your letter concerns a dossier of over-indebtedness already known to the Banque de France, you must recall its reference to 12 digits (the number assigned to the dossier by the Banque de France)

Who shall I contact

After sending (or filing) your file, you remain obliged to pay your current expenses (food, rent, ...) and to reimburse your credits. The filing of your file takes the form of a certificate of deposit sent to you by simple mail.

Certificate of deposit

After the transmission of your file, a certificate of deposit is sent to you by simple letter within a period of 2 working days.

The following information shall be included in the certificate:

- Number assigned to your debt distress report

- Contact details (telephone switchboard) of the commission that will examine your file

- Date of submission of your file. As of that date, the commission has three months to consider whether your file is admissible and what solutions are possible.

Suspension of certain seizures

If you have requested it in your file, certain execution procedures (seizures, ...) may be suspended.

Reminder

after filing your file, you remain obliged to pay your current expenses (food, rent, ...) and refund your credits.

Enrollment in Credit Incident File

The lodging of the file shall entail the applicant's entry in the National Personal Credit Refund Incident File (FICP).

Guardianship, curatorship, safeguarding justice

The case of over-indebtedness must be made by the guardian of the over-indebted person placed under guardianship.

Being an individual

You must meet these 2 conditions:

- Be a Frenchman domiciled in France or abroad, or be a foreigner domiciled in France

- Be of age or emancipated minor

FYI

Individual business If you are self-employedHowever, you cannot directly file for over-indebtedness, even if your debts only concern your personal wealth. You must first go to the court of law (if you are a farmer or a professional) or the commercial court (if you are a trader or craftsman).

If you own your principal residence (home):

Your application cannot be rejected on the grounds that you own your principal residence, even if its value would allow you to pay off all or part of your debts.

When you live in a couple (marriage, Civil partnerships, cohabitation), you have 3 possibilities :

- You can file a file with 2, in common (this solution is to be preferred if you have debts in common).

- You can each file your own file (if there are debts common to the couple, you will have to indicate and justify how the burdens are shared within your couple).

- You can file a file on your own, on your behalf (if there are debts common to the couple, you will have to indicate and justify how the burdens are shared within your couple).

If you are married and you are the only one to file a file:

- At the time of filing, you are the only one registered with the National Personal Credit Reimbursement Incident File (PPIF).

- When the case is declared admissible, only seizures against you are suspended. The creditor of your spouse may request the seizure of his or her property or of property that you have in common. But if you and your husband have common debts, the suspension you are given prevents the seizure of the common property.

- When the measures to deal with over-indebtedness are applied, you are the only beneficiary. As a result, creditors can claim from your spouse the payment of the debts you have in common with him.

FYI

if you live in Alsace-Moselle, you can file a debt distress report with the Banque de France and engage a civil bankruptcy procedure specific to the inhabitants of Alsace-Moselle, because the two devices coexist.

Being in debt

These may be expenses that you have not paid or cannot pay.

As a result, you can file an over-indebtedness file:

- if you can't pay off your debts

- or if you know that soon you will not be able to pay your expenses (example: invoice). For example, you know you're going to be unemployed and you don't have a job offer.

But only everyday expenses (debts that meet personal and/or family needs) are eligible for the debt overhang file:

- Bank debt: mortgage maturities, consumer loan maturities, overdrafts

- Current expenditure: rent arrears, unpaid bills (water, gas, electricity, telephone), tax arrears, ...

- Debts that exist because you have taken out the security of an individual (example: rental deposit) or a company (individual contractor or business)

Other debts are not taken into account in the over-indebtedness procedure or are treated differently:

- Professional debts, i.e. debts directly or indirectly connected with the professional activity pursued

- Maintenance debts (maintenance payments)

- Damages awarded to victims in connection with a criminal conviction

- Penal fines

To be of "good faith"

You have to be of good faith, that is to say not having made it impossible to pay your debts and to make a sincere declaration of over-indebtedness.

To complete your case, you can be assisted by a social worker present at the CCAS: titleContent, the mayor's office, in a budget advice point, at the Caf: titleContent, in your HLM office ... In this case, enter the name and contact information of this person in your file.

It is also possible to request information or make an appointment with the Banque de France via the internet:

Request for information or appointment at the Banque de France

Reminder

it is up to the guardian or trustee or agent to make the file of over-indebtedness.

The folder should contain the following documents:

- Form cerfa n°13594 to be printed and filled in

Declaration of over-indebtedness

- Proof of identity, resources, expenditure, debts and assets

One list of supporting documents is available.

- Letter signed to quickly explain your current situation and the causes of your debt overhang. In particular, indicate the seizures in progress of the property or income and, if necessary, the ongoing eviction procedure.

Répondez aux questions successives et les réponses s’afficheront automatiquement

Sending by mail

The file and supporting documents should be sent to:

Who shall I contact

Over-indebtedness: Bank of France postal address

Banque de France Over-indebtedness

TSA 41217

75035 PARIS CEDEX 01

Attention:

If your letter concerns a dossier of over-indebtedness already known to the Banque de France, you must recall its reference to 12 digits (the number assigned to the dossier by the Banque de France)

Wicket deposit

You can deposit your debt overhang file at a bank of France counter:

Who shall I contact

After sending (or filing) your file, you remain obliged to pay your current expenses (food, rent, ...) and to reimburse your credits. The filing of your file takes the form of a certificate of deposit sent to you by simple mail.

Certificate of deposit

After the transmission of your file, a certificate of deposit is sent to you by simple letter within a period of 2 working days.

The following information shall be included in the certificate:

- Number assigned to your debt distress report

- Contact details (telephone switchboard) of the commission that will examine your file

- Date of submission of your file. As of that date, the commission has three months to consider whether your file is admissible and what solutions are possible.

Suspension of certain seizures

If you have requested it in your file, certain execution procedures (seizures, ...) may be suspended.

Reminder

after filing your file, you remain obliged to pay your current expenses (food, rent, ...) and refund your credits.

Enrollment in Credit Incident File

The lodging of the file shall entail the applicant's entry in the National Personal Credit Refund Incident File (FICP).

Emancipated minor

Being an individual

These 2 conditions must be met:

- Be a Frenchman domiciled in France or abroad, or be a foreigner domiciled in France

- And not to engage in independent professional activity, that is to say not to be a farmer, a craftsman, a trader, a liberal profession or a micro-entrepreneur (self-employed person). Indeed, these professionals are part of a specific procedure. However, a micro-entrepreneur may benefit from the debt distress procedure if he waives this status before the debt distress commission examines his file.

If you own your principal residence (home):

Your application cannot be rejected on the grounds that you own your principal residence, even if its value would allow you to pay off all or part of your debts.

If you live as a couple (Civil partnerships, cohabiting)

When you live as a couple, you can:

- file a file with 2, in common (this solution is preferred if you have debts in common)

- or each file your own file (if there are debts common to the couple, you will have to indicate and justify how the burdens are shared within your couple)

- or file a single file on your behalf (if there are debts common to the couple, you will have to indicate and justify how the burdens are shared within your couple).

If you live in Alsace-Moselle

You can file a file for over-indebtedness with the Banque de France and engage a civil bankruptcy procedure specific to the inhabitants of Alsace-Moselle, because the two devices coexist.

Being in debt

These may be expenses that you have not paid or cannot pay.

As a result, you can file an over-indebtedness file:

- if you can't pay off your debts

- or as soon as you know that you will no longer be able to pay your expenses (e.g. bill) in the near future. For example, you know you're going to be unemployed and you don't have a job offer.

But only everyday expenses (debts that meet personal and/or family needs) are eligible for the debt overhang file:

- Bank debt: mortgage maturities, consumer loan maturities, overdrafts

- Current expenditure: rent arrears, unpaid bills (water, gas, electricity, telephone), tax arrears, ...

- Debts arising from a given guarantee to an individual or a company (individual contractor or business)

Other debts are excluded from the over-indebtedness procedure or are dealt with in special ways:

- Professional debts, i.e. debts directly or indirectly connected with the professional activity pursued

- Maintenance debt (alimony)

- Damages awarded to victims in connection with a criminal conviction

- Penal fines

To be of "good faith"

You have to be of good faith, which means:

- not having organized your insolvency (e.g. signing one or more loans with the intention of not repaying)

- and make a sincere declaration of debt distress.

To complete your case, you can be assisted by a social worker present at the CCAS: titleContent, the mayor's office, in a budget advice point, at the Caf: titleContent, in your HLM office ... In this case, enter the name and contact information of this person in your file.

It is also possible to request information or make an appointment with the Banque de France via the internet:

Request for information or appointment at the Banque de France

The folder should contain the following documents:

- Cerfa Form No. 13594

Declaration of over-indebtedness

- Proof of identity, resources, expenditure, debts and assets

One list of supporting documents is available.

- Letter signed to quickly explain your current situation and the causes of your debt overhang. In particular, indicate the seizures in progress of the property or income and, if necessary, the ongoing eviction procedure.

Répondez aux questions successives et les réponses s’afficheront automatiquement

Sending by mail

The file and supporting documents should be sent to:

Who shall I contact

Over-indebtedness: Bank of France postal address

Banque de France Over-indebtedness

TSA 41217

75035 PARIS CEDEX 01

Attention:

If your letter concerns a dossier of over-indebtedness already known to the Banque de France, you must recall its reference to 12 digits (the number assigned to the dossier by the Banque de France)

Wicket deposit

You can deposit your debt overhang file at a bank of France counter:

Who shall I contact

After sending (or filing) your file, you remain obliged to pay your current expenses (food, rent, ...) and to reimburse your credits. The filing of your file takes the form of a certificate of deposit sent to you by simple mail.

Certificate of deposit

After the transmission of your file, a certificate of deposit is sent to you by simple letter within a period of 2 working days.

The following information shall be included in the certificate:

- Number assigned to your debt distress report

- Contact details (telephone switchboard) of the commission that will examine your file

- Date of submission of your file. As of that date, the commission has three months to consider whether your file is admissible and what solutions are possible.

Suspension of certain seizures

If you have requested it in your file, certain execution procedures (seizures, ...) may be suspended.

Reminder

after filing your file, you remain obliged to pay your current expenses (food, rent, ...) and refund your credits.

Enrollment in Credit Incident File

The lodging of the file shall entail the applicant's entry in the National Personal Credit Refund Incident File (FICP).

Data subjects

Exclusions: trader, craftsman, ...

Personal Debt Overhang Commission

Jurisdiction and referral to the over-indebtedness commission

Referral to the personal debt overhang commission

Referral to the personal debt overhang commission

Competence of the Banque de France

FICP Enrollment

Exclusion from over-indebtedness procedure

Document template

Online service

FAQ

Service-Public.fr

Service-Public.fr

Service-Public.fr

Service-Public.fr

Banque de France

Banque de France

French Federation of Regional Chambers of Social Over-Indebtedness

Banque de France

National Institute of Consumer Affairs (INC)

Banque de France

Ministry of Health

National Institute of Consumer Affairs (INC)